How to Turn $100 Into $500 with Options — The Beginner’s Roadmap to Trading Mastery

What if you only had $100 and a big dream?

A dream to build income.

A dream to break free from the 9-to-5.

A dream to learn a real trading skill that could one day replace your paycheck.

Most people would scoff.

They’d say it’s not possible. That $100 isn’t enough to matter.

But they’re wrong.

In fact, $100 is exactly where you should start.

Not because you’ll get rich overnight—but because if you can grow $100 the right way, you’re learning exactly how to grow a $10,000 account later.

This article outlines the precise plan for how to go from $100 to $500 using credit spreads—a low-risk, high-probability options strategy that can be mastered in just a few weeks.

Let’s break it down step-by-step.

Why Start with $100?

There are three simple reasons why this challenge starts with $100:

Anyone can come up with it.

No more excuses. You don’t need thousands of dollars. If you can spare $100, you can start trading.It forces discipline.

With only $100, you must be precise. No gambling. No oversized trades. This challenge teaches discipline, and that’s the real secret to becoming a consistently profitable trader.It builds foundational skill.

If you can manage risk, stick to the rules, and grow a $100 account—then scaling that up to $1,000, $10,000, or more becomes a matter of repetition, not reinvention.

This is how real traders are built—from the ground up.

The Strategy: $1-Wide Credit Spreads on SPY

Let’s get into the system.

We’ll be using $1-wide credit or debit spreads on the SPY (S&P 500 ETF). Why SPY?

It’s liquid—tight spreads and easy fills.

It trades in predictable ranges.

It offers options with $1 strike widths.

And most importantly… it has a long-term bullish trend.

The beauty of a $1-wide spread is that it’s simple and low-risk.

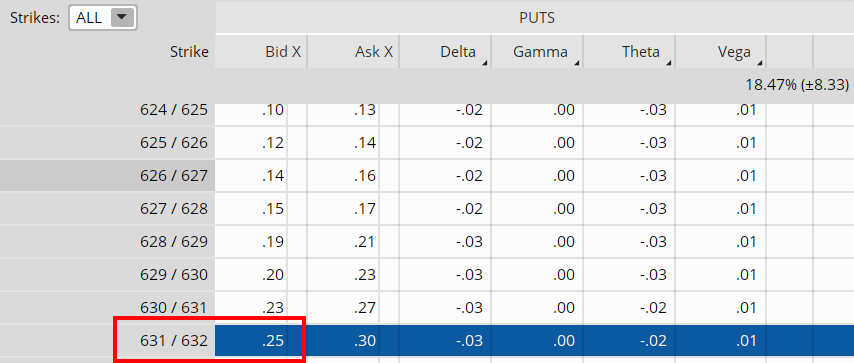

Example:

You open a bull put spread on SPY.

It costs $75 to enter and brings in a $25 credit.

If SPY stays above your strike, you earn 25% on the trade.

If not, your loss is capped at $75.

This structure keeps risk controlled while offering outsized percentage gains.

The Entry Setup: RSI + 3–7 Day Expiration

Timing matters. Even with a small trade.

Here’s how to pick your entry:

Look for a Dip

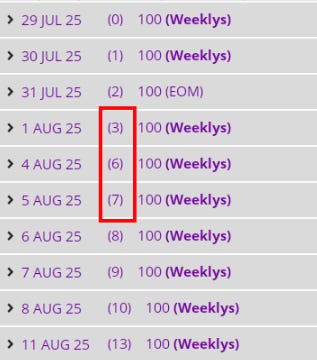

Check the hourly chart. When the RSI dips below 50, that’s your cue. This signals short-term weakness within an uptrend—an ideal time to enter a bullish credit spread.Set Expiration 3–7 Days Out

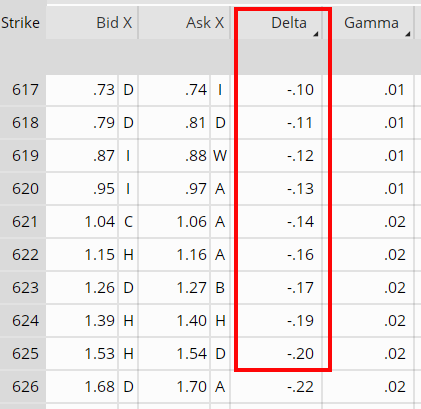

This gives your trade enough time to work while letting theta (time decay) benefit your position. The short expiration means faster wins and more chances to compound.Choose Delta 10–20

This gives your trade a high probability of success—typically 80–90% odds.

Summary Entry Criteria:

SPY bull put spread

RSI < 50 (on hourly)

3–7 DTE (days to expiration)

Delta 10–20 short leg

This gives you a simple, repeatable system that works.

Risk Management: The 50/50 Rule

In trading, risk comes first.

Here’s the rule:

Take profits at 50% gain.

If you collect a $20 credit, close the trade when you’re up $10.Cut losses at 50% loss.

If your spread costs $40 to enter and it drops to $20, get out.

This keeps your risk and reward in balance and protects your small account from disaster.

And let’s be real: your very first trade is crucial.

If you lose 100% of your $100 on Day 1, you’re done.

So don’t rush. Wait for the right entry and follow the system. This isn’t about betting. This is about building.

Compounding: The Power of Scaling Up

Once your account hits $200, you unlock the next phase:

You go from trading 1 spread…

To trading 2 spreads.

At $300, you can trade 3. At $400, you can trade 4.

Every time you grow your capital, your position size increases—but the risk per trade stays the same because your method doesn’t change.

This is the power of compounding trades.

As your account grows, you’re reinvesting the gains—not by risking more per trade, but by scaling your size proportionally. That’s how a $100 account can reach $500 in just a few weeks with consistent wins.

But What If You Lose?

Let’s be honest.

You will lose.

Not every trade is a winner—even with a high-probability setup.

But the secret is this:

You only need to win 2 out of 3 trades to keep growing.

Because each win might net you 25–50%, while each loss is capped.

The key is consistency, not perfection. Don’t let one bad trade knock you out of the game. Cut your losses. Move to the next. Protect your capital. And stick to the system.

Lessons That Go Beyond $100

You might think this is just a fun challenge.

But this $100 to $500 journey teaches critical trader identity skills:

Discipline: Wait for the setup. Follow the rules.

Risk control: No revenge trades. No doubling down.

System thinking: Rely on process, not hope.

Scaling: How to increase size without changing the plan.

These are the same habits you’ll need when your account hits $10,000 or $100,000.

The market doesn’t care how much you’re trading.

It only rewards those who play the game with skill.

What Happens After $500?

Once you hit the $500 milestone, it’s time for Phase 2.

That’s when you unlock:

Larger trade size

Advanced spread variations

Weekly income stacking

A deeper understanding of market movement

But don’t rush. First, build the base.

If you can trade $100 like a professional, you’ll never need to gamble again.

Final Thoughts: The Best Plan for New Traders

Let’s recap the plan:

Start with $100

Anyone can do it. No excuses.Trade $1-wide SPY credit spreads

Low-risk, high-probability, repeatable.Enter on RSI dips + 3–7 day expiry

Time entries for momentum reversals.Follow the 50/50 rule

Take profit at 50%, cut losses at 50%.Compound weekly

Grow from 1 to 2 to 3 trades as your account increases.Don’t rush

Wealth comes from doing the right thing again and again.

This isn’t just a challenge—it’s a training ground.

For your future. For your freedom. For your identity as a trader.

Want to Watch the Full Breakdown?

📺 I walk through this strategy in full detail in the video.

You’ll see my first trade, my entry strategy, and how I’m compounding week by week.

👉 Subscribe to the channel and follow along.

👉 Comment with your own results—I'm watching.

👉 Join the journey. Build the habit. Replace the paycheck.

P.S.

I wanted to let you all know that starting August 1st, we’re going to be raising our prices on the premium subscription. So if you want to get in at this price, there’s still time for you to do so!

Interesting article, thank very much. But which strikes do you advice? Do you only look at the delta < 20?