How to Find the Best Stocks for Selling Cash-Secured Puts

Generate Safe Weekly Income Using a Proven Stock Selection Process

One of the most common questions I get from new traders inside Freedom Income Options is:

“How do I know which stocks are best for selling cash-secured puts?”

It’s a great question—and one you must answer before you can execute this strategy with confidence and consistency.

Because even though the cash-secured put is one of the safest and most powerful tools we use to replace our paycheck with options, its success still depends on choosing the right stock.

Today’s training will walk you through my 3-step process to identify great stocks for CSPs. We’ll cover:

How to find stocks with strong upward momentum

Why you must prioritize company quality and revenue growth

How to choose the best option expiration for consistent profits

Let’s dive in.

(You should keep an eye on this one!)

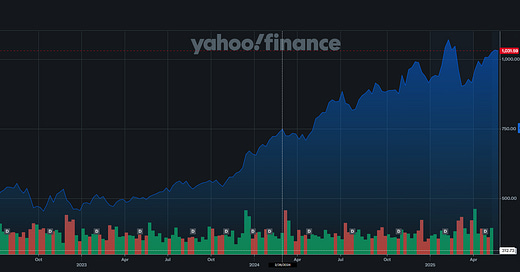

Step 1: Find Stocks That Are Going Up

Use the 200-Day Moving Average As Your Guide

The first and most important rule for selling puts is this:

Only sell puts on stocks that are trending up.

Why?

Because when you sell a put, you're making a deal:

You're saying, “I'll buy this stock at a lower price… if it drops.”

So the last thing you want is for the stock to collapse.

You want bullish strength, not weakness.

That’s where the 200-day moving average (MA) comes in.

It’s my primary trend filter—and it should be yours too.

Here’s how to use it:

✅ Rule: Only Trade Stocks Above the 200-Day Moving Average

The 200-day MA shows the long-term trend. When price is above it, buyers are in control.

When it’s below, the stock is often in trouble.

Example:

Let’s say you’re looking at stock XYZ. Here’s what to do:

Pull up a daily chart in your broker or charting tool (like TradingView or TrendSpider).

Add the 200-day moving average.

Look for price trading above that line.

Ideally, the 200-day MA is sloping up, not sideways.

If the stock meets that criteria, it’s a potential CSP candidate. If not, skip it.

Don’t try to be a hero by “catching the bottom.” That’s not what we do here.

We trade with probability, not prediction—and uptrends give us the edge.

Step 2: Only Choose Quality Companies

Look for Revenue Growth, Profitability, and Strong Brands

Finding stocks that are going up is great…

But we also want to make sure they’re companies we’d actually want to own.

Because when you sell a cash-secured put, there’s always a chance the stock gets assigned.

That means you’ll own 100 shares—so you better like the company.

Here’s how I filter for quality:

✅ 1. Check for Revenue Growth

Use a tool like Yahoo Finance, Finviz, or Seeking Alpha to review financials.

Look for positive year-over-year revenue growth.

Bonus points if earnings per share (EPS) is also rising.

Growth equals strength—and strength equals resilience.

✅ 2. Stick With Well-Known, Established Brands

Focus on companies with:

Proven business models

Wide customer bases

Competitive advantages

Examples:

Apple (AAPL), Microsoft (MSFT), McDonald's (MCD), Costco (COST), Visa (V)

These are companies that institutions love.

They’re less likely to collapse on bad news and often recover quickly.

✅ 3. Avoid Speculative or Unprofitable Stocks

A lot of traders make the mistake of selling puts on:

Meme stocks

Penny stocks

Pre-revenue biotech companies

Avoid these.

If the stock doesn’t have real earnings or a path to profitability, it’s a gamble—not a trade.

Remember: we want boring, safe, consistent income—not excitement.

(Another one you should watch for)

Step 3: Go Out About 30 Days on Your Options Trade

Balance Between Time Decay, Flexibility, and Return

Once you’ve found a stock that’s in an uptrend and a company you’d love to own…

Now it’s time to pick the right option contract.

This is where expiration dates matter.

Too short—and you don’t collect enough premium.

Too long—and you’re exposed to more market risk.

The sweet spot?

✅ Target 30 Days to Expiration (DTE)

Here’s why:

You collect a solid premium without overexposing yourself.

You benefit from accelerating time decay in the final 2 weeks.

You maintain flexibility to roll or adjust the trade if needed.

If you’re selling a put on May 20th, you’d typically choose an expiration around June 21st (give or take a few days).

Bonus Tip: Sell Below Support for Extra Safety

Once you’ve selected your expiration date:

Pull up the chart.

Find a recent support level—a price the stock bounced off before.

Sell a put below that support.

This gives you a “double layer” of protection:

Technical support

Plus the option premium as a buffer

It’s a powerful way to reduce risk while still generating income.

Real-World Example

Let’s walk through a recent example from inside the Freedom Income Options community:

Ticker: McDonald’s (MCD)

Uptrend?

✅ Price above the 200-day MA and rising steadily.Company Quality?

✅ Global brand, profitable, consistent revenue growth.Option Setup:

Sell the $260 strike cash-secured put

Expiration: 30 days out

Premium collected: $2.40 per share

Return on capital: 0.92% in one month

If price stays above $260, you keep the premium.

If it dips below $260, you own McDonald's at a discount—plus you already got paid.

Either way, you win.

That’s the power of cash-secured puts done right.

Recap: The 3-Step Stock Selection Framework

Here’s a quick recap of the system:

🔍 Step 1: Find Uptrending Stocks

Price above the 200-day moving average

Upward slope is ideal

🏢 Step 2: Choose Quality Companies

Growing revenue and EPS

Strong brand and consistent performance

Avoid speculative names

⏳ Step 3: Pick 30-Day Expirations

Balance between time decay and risk

Use support levels to guide your strike price

This 3-part filter ensures you’re always selling puts on the best possible stocks, with the highest probability of profit.

And once you do this consistently—every week—it becomes a true income machine.

(Another one you should keep an eye on)

What You’ll Feel, Have, and Know

Let’s break this down using the Three Fascinations framework:

🧠 What You’ll Know:

How to spot high-probability CSP setups

Which companies are safest to trade

How to structure trades for consistent 1% monthly returns

💼 What You’ll Have:

A repeatable system for generating options income

A watchlist of strong stocks with reliable setups

Trades that align with your risk tolerance and income goals

💪 What You’ll Feel:

Confident placing trades, even in uncertain markets

Empowered to control your income

Calm, because you’re following a proven system—not gambling

Helping you replace your paycheck with options—one trade at a time.

Stay disciplined. Stay consistent. Stay free.

Casey Stubbs

Freedom Income Options

Replace Your Paycheck, Reclaim Your Freedom.