“If you don’t feel like a fool, you’re not managing risk.”

– Mark Minervini, July 31, 2025

That quote sums up one of the most disciplined, explosive trading strategies ever used in real markets. And it’s not just theory — it’s a system that helped Mark Minervini win the U.S. Investing Championship with a 155% return in a single year.

So how did he do it?

It wasn’t by trading all day.

It wasn’t by gambling or hoping.

It was by perfecting a system — one based on timing, tight entries, and relentless risk control.

Today, we’re breaking down the exact framework behind that strategy… and how you can apply the same principles to build your own income engine.

🧠 Who Is Mark Minervini?

Mark Minervini is a U.S. champion trader, author, and one of the most respected growth stock traders in the world. He’s been featured in Stock Market Wizards by Jack Schwager and has developed a powerful methodology that blends CAN SLIM-style fundamentals with laser-focused technical entries.

But his most well-known claim to fame?

👉 Turning a personal account into a massive, compounded return with minimal drawdowns — and winning the 1997 U.S. Investing Championship with a 155% gain.

That kind of performance doesn’t happen by accident.

Let’s break down how he did it.

⚙️ The Foundation: SEPA — Specific Entry Point Analysis

At the heart of Minervini’s success is a methodology he calls SEPA — Specific Entry Point Analysis.

This system is built on one idea:

Only take trades when everything aligns — fundamentally, technically, and emotionally.

Here’s how it works:

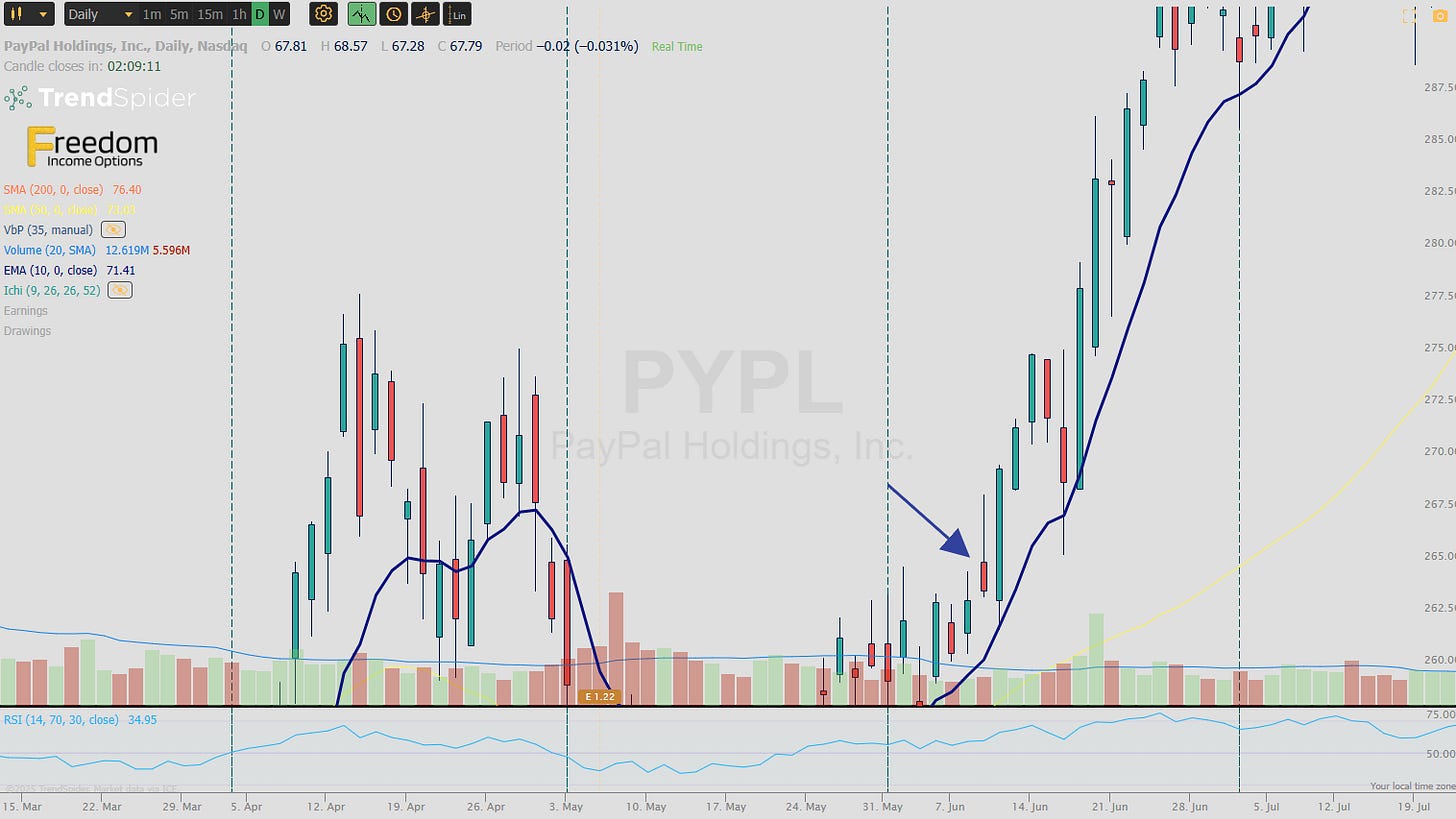

This is the PYPL trade that he took and where he entered on June 9, 2021.

🔍 1. Stock Selection: The SEPA Filter

Minervini doesn’t trade everything that moves. He’s extremely selective. Before even thinking about a trade, the stock must meet these core criteria:

High earnings and sales growth

Strong return on equity (ROE)

Leading industry position

Strong relative strength

Clear institutional support

He focuses on companies in early stages of explosive growth — often small- to mid-cap names that are just breaking out of stealth mode.

📊 2. Chart Pattern Recognition: Tight Is Right

Once the fundamentals check out, Minervini turns to the chart.

He’s not looking for random breakouts. He’s looking for tight price action — the kind that signals institutional accumulation.

His favorite patterns include:

Volatility Contraction Patterns (VCPs)

Cup-with-handle bases

Flat bases

Tight flags or pennants

The tighter the consolidation, the better. Tight setups mean low risk, high reward, and clear stop levels.

“Volatility contraction is like coiled energy. The tighter it gets, the bigger the potential move.”

– Mark Minervini

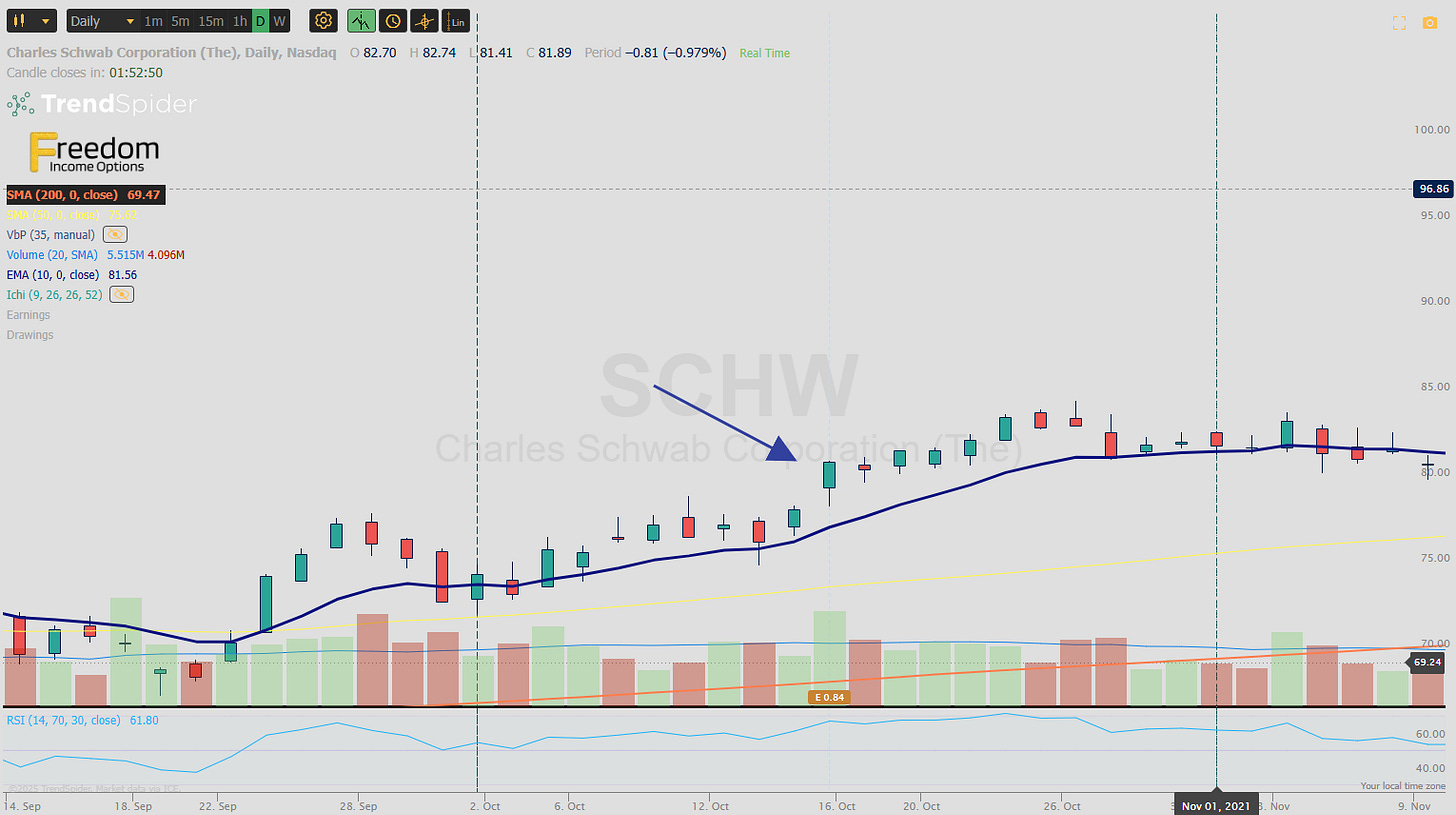

This is the SCHW trade he took and entered on October 15, 2021.

✅ 3. Entry Timing: The Breakout Sweet Spot

This is where SEPA really shines.

Minervini waits until the stock proves itself by breaking out of its base on volume. He enters at a precise price — not chasing, not guessing.

He often uses:

Pivot point entries

Buy-stop limit orders

Stops placed just below the most recent support

This gives him maximum upside with minimum downside — a critical part of compounding safely.

🛡️ 4. Risk Management: The SEPA Advantage

If there’s one reason Minervini is still in the game after 30+ years, it’s this:

He never lets a small loss become a big loss.

His rules are brutal in the best way:

Stop losses are usually 5–8% max

He never averages down

He sizes positions so that no single loss hurts his account

He often says:

“Trading is about losing well. Anyone can win big. But most people can’t lose small — and that’s why they fail.”

This is where most traders fall apart. They focus on how much they could make, while Minervini focuses on how little he can lose.

📉 5. Market Timing: Only Strike When It’s Safe

Even the best setups will fail in a bad market.

That’s why Minervini always checks the general market condition before trading aggressively.

His key indicators:

Price above 50-day and 200-day moving averages

Market breadth (advancers vs. decliners)

Distribution days (heavy-volume selloffs)

Leading stocks showing strength

He’s not afraid to sit in cash when the market is weak — and he ramps up exposure only when all signs flash green.

This is the trade NUE that he took and entered on August 9, 2021

🧠 A Trader’s Mindset: Aggressive Yet Controlled

Minervini isn’t just a system guy. He trains traders to develop a champion’s mindset — because discipline beats everything.

His core principles:

Execute the system without hesitation

Control emotions — especially fear and greed

Journal everything

Review mistakes weekly

Focus on process, not outcome

This mindset is why Minervini doesn’t just win once — he compounds year after year.

💡 How You Can Apply This To Your Own Trading

You may not be aiming for a 150% year. But what if you could consistently generate 1–2% weekly, using a simplified version of Minervini’s edge?

That’s exactly what we focus on at Freedom Income Options.

We simplify the edge. We share high-probability trades. We guide your entries. We keep your losses small. And we help you build a second income that replaces your paycheck — one smart trade at a time.

This isn’t theory. It’s a system. Just like Minervini’s — with the same commitment to discipline, clarity, and risk management.

✅ Key Takeaways

You don’t need dozens of trades. Just a few high-quality setups.

Tight price action = high probability.

Never risk big. Cut losers early.

Only trade when both the stock and the market align.

Focus on the process, not the outcome.

📌 Final Thought: Winners Stack the Odds

Mark Minervini won the U.S. Investing Championship because he had a clear plan, a precise system, and an iron grip on risk.

That’s the edge.

If you want to build a consistent income from the markets, you need a system like that — and you need to follow it with discipline.

That’s why I built Freedom Income Options: to help traders like you win with structure, simplicity, and support.

Helping you replace your paycheck with options—just like the pros.

Casey Stubbs

Freedom Income Options

Replace Your Paycheck, Reclaim Your Freedom.

P.S.

We use the same strategy that elite traders like Mark Minervini rely on to find powerful trade setups. Our premium members get access to these high-probability opportunities every week. Ready to trade like a pro? Join us today.

What a gem!! I will reread few times to supplement my uvcmi system